Explore how chemical distribution trends impact global pharma supply chains, covering market growth and supply security initiatives.

Chemical distributors, pharmaceutical ingredient suppliers, and other material suppliers play crucial roles in bio/pharmaceutical development and manufacturing. With increased product and supply chain complexity, this article examines the key trends and issues impacting markets and supply chains.

Market Size and Top Chemical Distributors

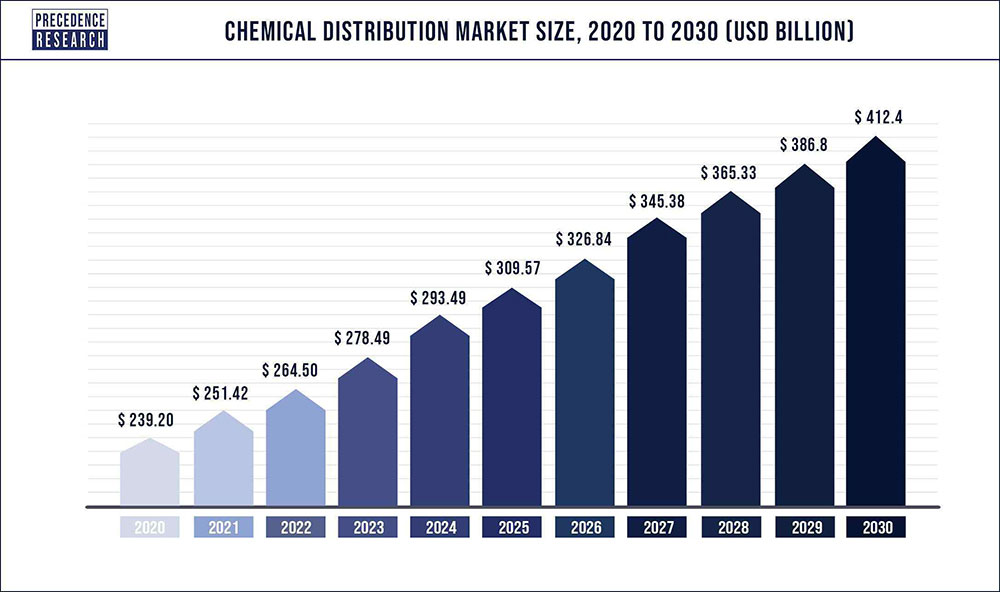

Chemical distribution spans a wide range of products, markets, and industries. Essential raw materials are produced and supplied by the chemical industry to businesses in manufacturing and industrial sectors. These raw materials are either sold directly by producers or distributed to end users by external distributors. The distribution of commodity and specialty chemicals by third parties is predicted to grow more than direct sales to end users due to the outsourcing of value-added services, such as logistics, packaging, blending, waste removal, inventory management, and technical training, according to Grand View Research, a business intelligence firm based in San Francisco, California.

The global chemical distribution market was valued at $256.6 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 6.3% from 2024 to 2030, according to Grand View Research. Rising chemical consumption in various end-use industries, including pharmaceuticals, construction, polymers and resins, and plastics, is projected to drive this demand.

Among the top global chemical distributors, Germany-based Brenntag leads with $18.6 billion in 2023 sales, followed by US-based Univar Solutions at $11.5 billion, US-based Tricon Energy at $10.6 billion, Japan-based Nagase & Co at $6.5 billion, and Netherlands-based IMCD at $5.1 billion. The regional leaders are Brenntag (Europe), Univar Solutions (North America), Nagase & Co (Asia Pacific), and Tricon Energy (Latin America/Middle East & Africa). The ICIS Top 100 Chemical Distributors ranking is based on 2023 sales and year-end 2023 currency exchange rates.

The ICIS Top 100 Chemical Distributors was compiled with support from several industry associations, including the European Association of Chemical Distributors, the US-based Alliance for Chemical Distribution, Associquim (the Brazilian Association of Chemical and Petrochemical Distributors), Responsible Distribution Canada, the UK-based Chemical Business Association, and the Netherlands-based International Chemical Trade Association.

Pharma Ingredient Supply Lines

Raw materials, chemicals, and related inputs used in pharmaceutical production represent just one segment of the global chemical distribution market. Broader issues impacting pharmaceutical supply chains include policy moves to increase manufacturing in the European Union (EU) and reduce dependence on other countries for active pharmaceutical ingredients (APIs) and related inputs for critical medicines. In April 2024, the European Commission launched the Critical Medicines Alliance. First announced in October 2023, the Alliance focuses on industrial policy and complements the reform of the EU’s pharmaceutical legislation.

The Alliance aims to enhance supply security, strengthen the availability of medicines, and reduce EU supply-chain dependencies. Recommendations from the Alliance will form the basis of a multi-year strategic plan with milestones and deadlines for implementation. Key factors being analyzed include over-dependency on a limited number of external suppliers, limited diversification possibilities, and limited production capacities. This builds on the European Commission’s analysis of supply-chain bottlenecks for critical medicines, which listed over 200 active substances essential for healthcare systems across the EU/European Economic Area.

The European Commission’s vulnerability analysis for 11 critical medicines was published in April 2024. The findings will inform the mandate of the Critical Medicines Alliance. The Commission will evaluate the remaining medicines on the list, recommend priority actions, and propose new tools to address identified challenges, focusing on mitigating structural risks, reinforcing supply, encouraging diversification, and boosting EU manufacturing.

Industry Efforts and Recommendations

The European Chemical Industry Council (Cefic), representing EU chemical manufacturers, is a member of the Critical Medicines Alliance. Through its sector group, the European Fine Chemicals Group (EFCG), Cefic supports potential policy moves to advance fine chemical manufacturing in the EU. In November 2023, EFCG issued recommendations for fostering supportive legislative policies for EU API manufacturers, emphasizing sustainable growth, reshoring initiatives, innovation investment, and procurement focused on supply security and social-environmental standards.

EFCG highlighted the decline of European-based API production for critical medicines, noting that the EU’s share of global API production fell from 53% in 2000 to 25% in 2020 due to increased competition from lower-cost countries and unfavorable EU pricing and procurement policies. These recommendations aim to reverse this trend and strengthen EU-based manufacturing.

Global Pharma

Global Pharma

Comments are closed.