Despite sluggish growth in Q2 2024, dealmakers in the Global Pharma sector remain optimistic. Learn about the factors driving future transactions.

Despite a sluggish growth in global mergers and acquisitions (M&A) activity in the second quarter of 2024, many dealmakers remain optimistic. They forecast an uptick in transactions for the latter half of the year, driven by various factors including private equity activity and corporate confidence.

Current State of Global M&A

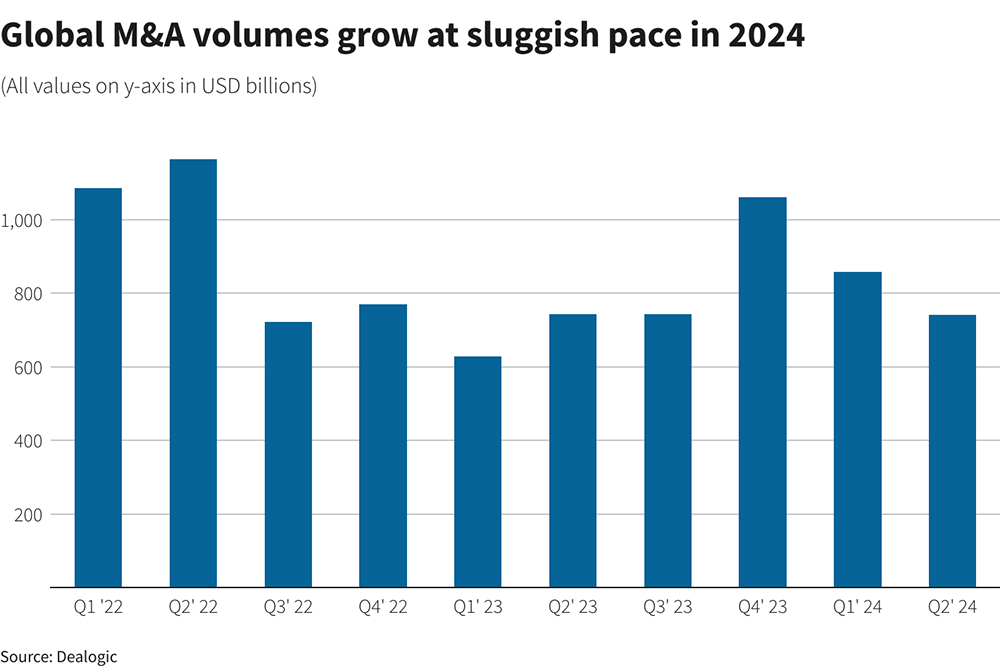

Global M&A activity experienced a slow growth in the second quarter of 2024. According to Dealogic data, the number of deals signed globally fell by 21% to 7,949. However, deal volumes saw a modest increase of 3.7%, reaching $769.1 billion. Notably, the number of deals worth $10 billion or more dropped to six from eight in the same period last year.

The M&A market faced several challenges, including high interest rates, a hostile regulatory environment, and a frothy stock market leading to high valuations. These factors collectively weighed down dealmaking activities over the past three months.

Optimism Among Dealmakers

Top investment bankers and deal lawyers remain optimistic about the M&A market. They cite strong CEO confidence and a robust economic outlook as key reasons for their positive projections. Damien Zoubek, co-head of U.S. corporate and M&A at Freshfields Bruckhaus Deringer, expressed confidence, saying, “It just feels like a regular old M&A year, and I think we’ll just keep cruising along.”

Some advisers noted that the current rate of dealmaking aligns with pre-pandemic levels seen in 2018 and 2019, when deal volumes averaged around $4 trillion annually. This historical perspective offers a sense of normalcy and stability in the current market conditions.

Private Equity’s Surge

Private equity firms have played a significant role in driving M&A activity. In the first half of 2024, buyout activity surged by 41%, reaching $286 billion. This increase was mainly due to a higher number of take-private deals, giving hope for a return of large leveraged buyouts in the near future.

Jay Hofmann, co-head of M&A for North America at JPMorgan, highlighted the potential revitalization of private equity activity in the second half of the year. He pointed out the ongoing “arm-wrestling match” between valuations and the desire to deliver high returns as a driving force.

Regional M&A Trends

U.S. Market

U.S. M&A volumes saw a slight decline of 3% during the quarter, amounting to $324.4 billion. Despite this, the overall outlook remains positive due to strong corporate balance sheets and continued interest in sizable targets.

European Market

In contrast, Europe experienced a rebound in deal activity, with volumes jumping by 27%. This growth was driven by the value of large transactions and improved macroeconomic conditions. Cathal Deasy, global co-head of investment banking at Barclays, noted the attractiveness of valuations and a moderating rate environment as key factors.

Asia-Pacific Market

The Asia-Pacific region faced an 18% decline in deal volumes. However, dealmakers remain hopeful as market conditions stabilize and investment opportunities arise.

Driving Factors Behind M&A Recovery

The increased availability of capital, particularly from private credit funds, has been instrumental in driving M&A recovery. These funds are increasingly taking market share from traditional bank loans, providing more financing options for dealmakers. Dan Mendelow, co-head of U.S. investment banking at Evercore, emphasized the growing role of private credit funds in the financing markets. He noted that banks are partnering with private credit funds or raising their own funds to stay competitive.

Several high-profile transactions marked the second quarter of 2024. These included ConocoPhillips’ $22.5 billion takeover of Marathon Oil, Silver Lake’s $13 billion take-private of Endeavor Group Holdings, and Johnson & Johnson’s $13 billion acquisition of Shockwave Medical.

Emerging Trends

Top M&A rainmakers have observed early signs of a narrowing gap in valuation expectations between buyers and sellers. This trend is attributed to a more stable economic outlook and expected downward trajectory of interest rates.

Corporate clarity deals, including spin-offs and carve-outs, have emerged as a bright spot in the M&A market. These structured transactions allow companies to separate non-core or low-growth businesses, providing flexibility and appealing to third-party bids.

Despite a sluggish second quarter, the global M&A market is poised for a resurgence in the latter half of 2024. The optimism among dealmakers, coupled with increased private equity activity and a narrowing valuation gap, suggests a promising outlook. As corporations continue to pursue strategic acquisitions and private credit funds provide ample financing options, the M&A landscape is set for robust growth, reflecting the resilience and adaptability of the market in navigating current challenges.

Global Pharma

Global Pharma

Comments are closed.