Explore the latest trends transforming contract development and manufacturing organizations and their pharma impact.

The Contract Development and Manufacturing Organization (CDMO) market is a cornerstone of the pharmaceutical and biotechnology industries, offering a comprehensive range of services such as drug development, manufacturing, and distribution. By partnering with CDMOs, pharmaceutical companies can focus on core activities like research and marketing, driving innovation and efficiency in the sector. According to recent market research, the global CDMO market is projected to reach $200 billion by 2025, with a compound annual growth rate (CAGR) exceeding 7%.

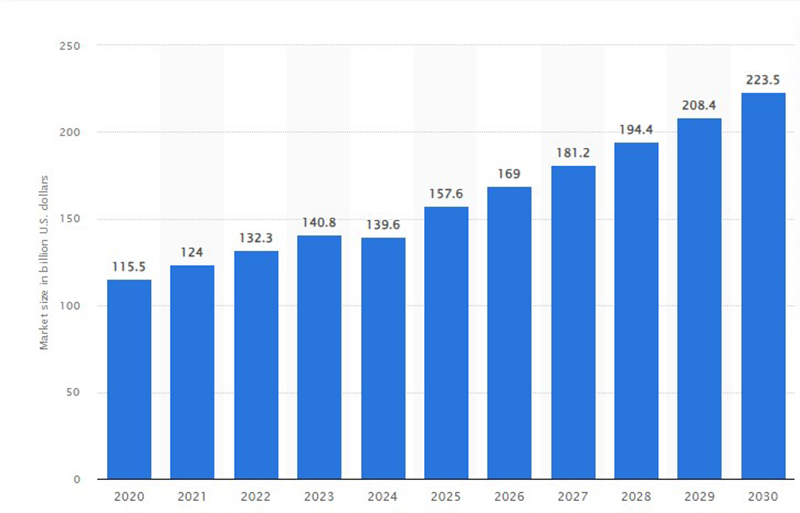

As per global data and business intelligence platform, Statista, Contract Development and Manufacturing Organization (CDMO) market forecast worldwide from 2020 to 2030(in billion U.S. dollars) mentioned below:

As per the experts forecast, In India, the CDMO market is expected to grow at a CAGR of 11.34% from $15.63 billion in 2023 to $26.73 billion by 2028. This growth is expected to be driven by opportunities for API and contract research from new molecules that are going off-patent in the coming years. Here is a detailed look at what is driving the growth in this sector:

Rising Demand for Pharmaceuticals and Biopharmaceuticals

The Driving Forces

The rising prevalence of chronic diseases, an aging population, and increased healthcare spending are the primary factors driving demand for pharmaceuticals and biopharmaceuticals. As these factors converge, the CDMO market experiences significant growth, bolstered by the outsourcing of drug development and manufacturing to CDMOs. This trend helps pharmaceutical companies reduce costs, enhance flexibility, and concentrate on their core competencies.

Outsourcing Trends and Market Impact

Outsourcing has become a vital strategy for pharmaceutical companies, allowing them to leverage the expertise and infrastructure of CDMOs. This shift is particularly pronounced in the development of biologics and personalized medicine, where advanced technologies and specialized capabilities are essential. As a result, CDMOs are becoming indispensable partners in the pharmaceutical supply chain.

Focus on Regulatory Compliance

Navigating complex regulatory environments is a significant challenge for pharmaceutical companies. CDMOs with strong regulatory expertise and robust compliance frameworks are in high demand, ensuring that products meet stringent quality standards and regulatory requirements.

Innovation and Technological Advancements in CDMOs

Embracing Advanced Technologies

Innovation is the lifeblood of the pharmaceutical industry, and CDMOs are at the forefront of adopting advanced technologies. From process automation to data analytics, CDMOs are leveraging cutting-edge solutions to enhance efficiency, reduce costs, and improve product quality. The integration of artificial intelligence (AI) and machine learning (ML) is revolutionizing drug discovery and manufacturing optimization, making CDMOs key players in the development of novel therapies.

Continuous Manufacturing and Quality Assurance

Continuous manufacturing is gaining traction in the CDMO market due to its potential for improved efficiency, reduced waste, and enhanced quality control. By investing in continuous manufacturing technologies, CDMOs can offer more reliable and scalable solutions to their clients, ensuring consistent product quality and compliance with regulatory standards.

Personalized Medicine and Customized Solutions

The demand for personalized medicine is driving the need for flexible and customized manufacturing solutions. CDMOs are responding by offering tailored services that cater to the specific needs of individual patients and therapies, positioning themselves as crucial partners in the development of next-generation treatments.

Geographical Expansion and Emerging Markets

Growth in North America and Europe

North America and Europe remain the largest markets for CDMOs, driven by robust pharmaceutical industries, high R&D investment, and advanced healthcare infrastructure. These regions continue to lead in terms of innovation and regulatory compliance, making them key hubs for CDMO activities.

Rapid Expansion in Asia-Pacific

The Asia-Pacific region is the fastest-growing market for CDMOs, driven by increasing pharmaceutical production, cost advantages, and expanding healthcare infrastructure. Countries like India and China are becoming major players in the CDMO market, offering cost-effective solutions and access to new markets. As per experts, the CDMO market in India is expected to grow at a CAGR of 11.34% from $15.63 billion in 2023 to $26.73 billion by 2028, driven by opportunities in API and contract research.

Opportunities in Emerging Markets

Emerging markets in Latin America, the Middle East, and Africa are also showing significant growth potential. Improving healthcare systems and increasing demand for pharmaceuticals are driving the expansion of CDMO services in these regions, providing new opportunities for growth and investment.

Challenges and Competitive Landscape

Regulatory Compliance and Quality Assurance

Maintaining compliance with stringent and varying regulations across different regions is a major challenge for CDMOs. Ensuring consistent product quality and managing risks associated with manufacturing processes are critical issues that CDMOs must address to remain competitive.

High Capital Investment and Intellectual Property Concerns

Establishing and maintaining state-of-the-art facilities requires significant capital expenditure. Protecting clients’ intellectual property and ensuring data security are also critical issues for CDMOs, requiring robust systems and processes to safeguard sensitive information.

Competitive Landscape and Pricing Pressures

The CDMO market is highly competitive, with numerous players vying for market share. This competition leads to pricing pressures, requiring CDMOs to continually innovate and improve their service offerings to differentiate themselves and attract clients.

The growth is shaped by many key aspects ranging from technology, regulation, quality to logistical requirements. Here are the fourteen key trends that will continue to shape the CDMO sector in the coming time:

1. Accelerated Biopharmaceutical Development

The rise of biopharmaceuticals and personalized medicine has led to a surge in demand for CDMOs offering specialized expertise in biologics development and manufacturing. Biopharmaceuticals require intricate processes and advanced technologies, prompting companies to outsource these functions to CDMOs. Agile and flexible manufacturing capabilities are essential, especially with expedited timelines for drug development in response to global health crises like COVID-19.

2. Increased Focus on Quality and Regulatory Compliance

In an industry where patient safety and product efficacy are paramount, stringent regulatory standards and quality assurance measures are crucial. CDMOs face heightened scrutiny from regulatory authorities worldwide, necessitating adherence to comprehensive quality systems and compliance frameworks. Partnerships with CDMOs known for their robust quality management systems and regulatory expertise are increasingly sought after.

3. Emergence of Advanced Technologies

Innovation drives the pharmaceutical industry, and CDMOs are embracing advanced technologies to enhance efficiency, reduce costs, and improve product quality. From process automation to data analytics and continuous manufacturing, CDMOs leverage cutting-edge technologies to stay ahead. Integration of artificial intelligence (AI) and machine learning (ML) revolutionizes drug discovery and manufacturing optimization, positioning CDMOs as invaluable partners in the quest for novel therapies.

4. Shift towards Integrated Services and End-to-End Solutions

Pharmaceutical companies seek streamlined processes and greater collaboration across the drug development lifecycle, leading to a shift towards integrated services and end-to-end solutions offered by CDMOs. Rather than engaging multiple vendors, companies prefer partnering with CDMOs capable of providing comprehensive services from early-stage development to commercial manufacturing. This fosters efficiency and minimizes risks associated with managing multiple vendors.

5. Expansion of Outsourcing to Emerging Markets

Globalization has led to increased outsourcing of manufacturing operations to emerging markets like India, China, and Brazil. These countries offer cost-effective solutions coupled with regulatory compliance and technological capabilities. CDMOs in emerging economies play a significant role in optimizing supply chains and accessing new markets, meeting evolving needs in the pharmaceutical industry.

6. Small Molecules:

In the realm of CDMO/CMO services, small molecule manufacturing remains pivotal, given the dominance of small molecule drugs in the pharmaceutical landscape.

7. Outsourcing of API Synthesis:

Pharmaceutical companies are increasingly outsourcing the synthesis of active pharmaceutical ingredients (APIs) to CDMOs/CMOs to streamline operations, cut costs, and leverage specialized expertise. This trend underscores the importance of strategic partnerships in small molecule development.

8. Adoption of Continuous Manufacturing:

Continuous manufacturing is gaining momentum in small molecule production due to its potential for improved efficiency, reduced waste, and enhanced quality control. CDMOs/CMOs are actively investing in this technology to stay ahead in the competitive landscape.

9. Biologics:

Biologics, characterized by complex manufacturing processes, are witnessing rapid growth within the pharmaceutical industry. CDMOs/CMOs play a crucial role in biologics development and production. Key trends include:

10. Biosimilars Development:

With patents expiring for several blockbuster biologics, there is a rising demand for biosimilars. CDMOs/CMOs are actively involved in biosimilar development, offering cost-effective solutions for manufacturing and regulatory support, thus tapping into this lucrative market opportunity.

11. Cell and Gene Therapies:

The emergence of cell and gene therapies signifies a transformative shift in healthcare, offering potential cures for previously untreatable diseases. CDMOs/CMOs are investing in specialized facilities and expertise to support the development and manufacturing of these innovative therapies, thereby positioning themselves as key players in this rapidly evolving landscape.

12. Drug Products:

Final formulation and packaging are critical stages in the drug development process, where CDMOs/CMOs play an indispensable role in ensuring product quality, compliance, and timely delivery. Key activities in this segment include:

13. Formulation Development:

CDMOs/CMOs collaborate closely with pharmaceutical companies to develop optimized formulations for drug products, taking into account factors such as stability, bioavailability, and patient convenience. This collaborative approach ensures the development of high-quality and efficacious pharmaceutical products.

14. Packaging Innovation:

Packaging plays a pivotal role in drug delivery, compliance, and patient safety. CDMOs/CMOs are at the forefront of innovation, investing in advanced packaging solutions such as smart packaging technologies and patient-centric designs to meet the evolving demands of the market.

The CDMO sector is a dynamic and integral part of the pharmaceutical and biotechnology industries. Its growth is fueled by the increasing complexity of drug development, regulatory pressures, and the need for cost-effective and flexible manufacturing solutions. By navigating challenges and leveraging emerging trends, CDMOs are well-positioned to support the pharmaceutical industry’s evolving needs and drive future advancements in healthcare.

Contract Development and Manufacturing Organization

Contract Development and Manufacturing Organization

Comments are closed.