Explore key drug approvals and innovation trends in 2024, with insights on how pharma sourcing platforms add value.

As the pharmaceutical industry continues to advance, tracking the pace and nature of new drug approvals offers valuable insights into product innovation. At the midpoint of 2024, the US Food and Drug Administration’s (FDA) Center for Drug Evaluation and Research (CDER) has approved 22 new molecular entities (NMEs) and therapeutic biologics. This level of activity reflects a steady rate of innovation, maintaining recent trends in drug approvals.

New Drug Approvals: A Mid-Year Review

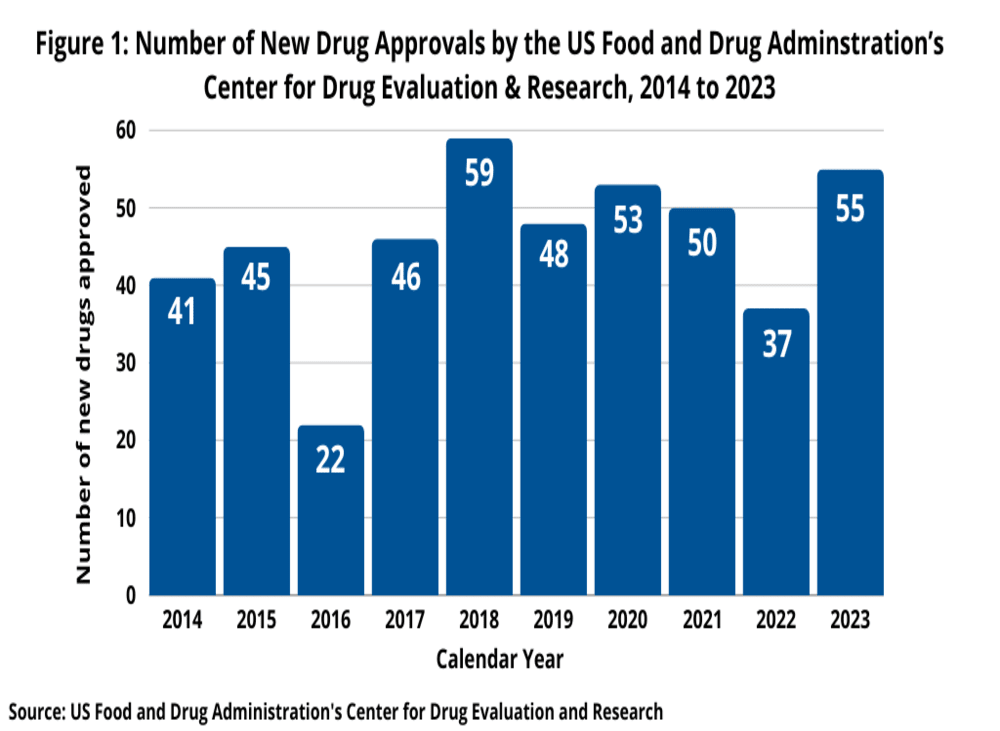

The first half of 2024 has seen a continuation of robust activity in new drug approvals, mirroring the strong performance of recent years. In 2023, the FDA’s CDER approved 55 NMEs and new therapeutic biologics, marking a significant 49% increase from the 37 approvals in 2022. This uptick reversed the previous year’s dip and was consistent with recent trends, with 50 new drugs approved in 2021 and 53 in 2020. The 2023 approvals were the second highest in the past decade, following a peak of 59 new drugs in 2018 (see Figure 1).

Small Molecules vs. Biologics

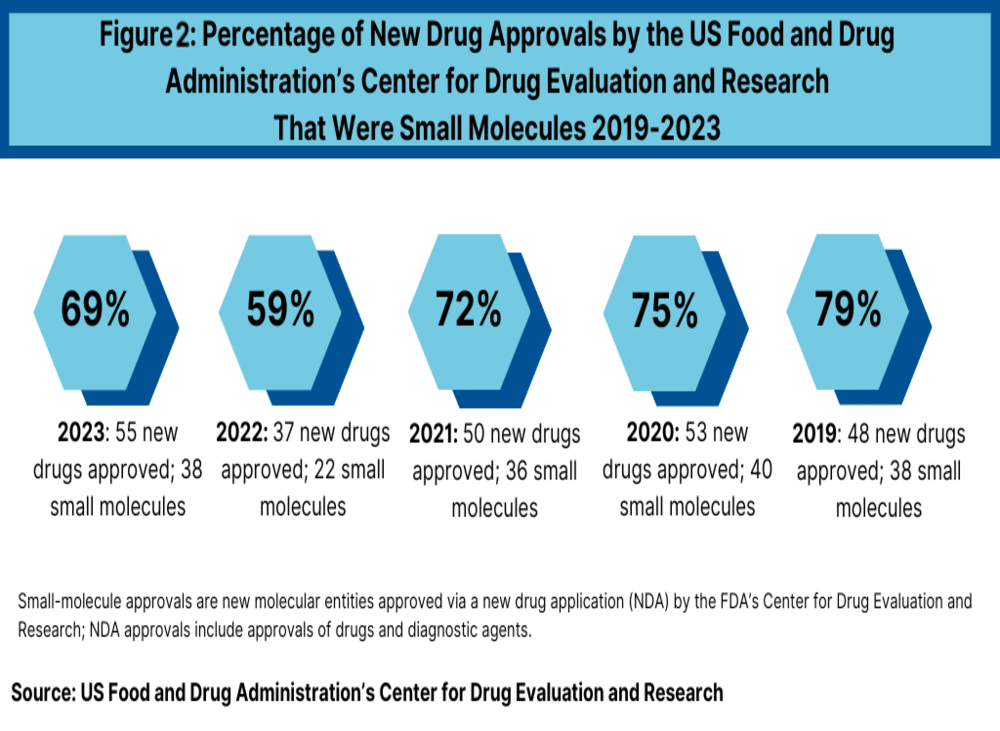

A key trend in drug approvals is the balance between small molecules and biologics. Of the 22 new drug approvals in 2024 thus far, 15 (68%) are small molecules, while 7 (32%) are biologics. This distribution aligns closely with 2023, where 69% of approvals were small molecules and 31% were biologics (see Figure 2). However, the share of small molecules saw a significant dip in 2022, dropping to 59% due to a reduction in overall approvals and a rise in biologics.

Between 2018 and 2021, small molecules consistently represented 71% to 79% of new drug approvals. The decline in 2022 was attributed to fewer overall approvals and an increase in biologics, with 2022 seeing 22 small molecules and 15 biologics. The rise in biologics in 2023 to 17 approvals matched the levels seen in 2018 and exceeded earlier years like 2021, 2020, and 2019 (see Figure 2).

Big Pharma vs. Mid-Tier and Smaller Companies

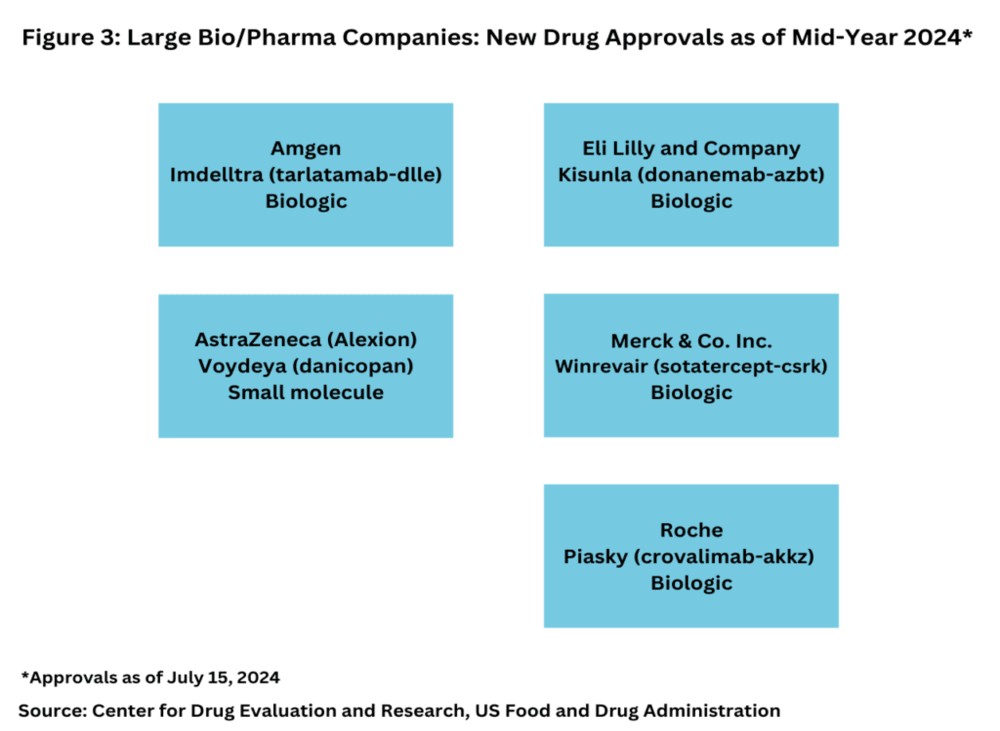

While the volume of new drug approvals is not the sole indicator of market strength, examining which companies are driving these approvals provides additional context. In the first half of 2024, only five of the new drugs were from major pharmaceutical companies (defined as the top 20 based on 2023 revenues). Notably, four of these were biologics: Amgen’s Imdelltra (tarlatamab-dlle) for extensive-stage small cell lung cancer; Eli Lilly’s Kisunla (donanemab-azbt) for early symptomatic Alzheimer’s disease; Merck’s Winrevair (sotatercept-csrk) for pulmonary arterial hypertension; and Roche’s Piasky (crovalimab-akkz) for paroxysmal nocturnal hemoglobinuria (PNH) (see Figure 3). The sole small-molecule approval from a major company was AstraZeneca’s Voydeya (danicopan) for treating PNH in combination with other therapies.

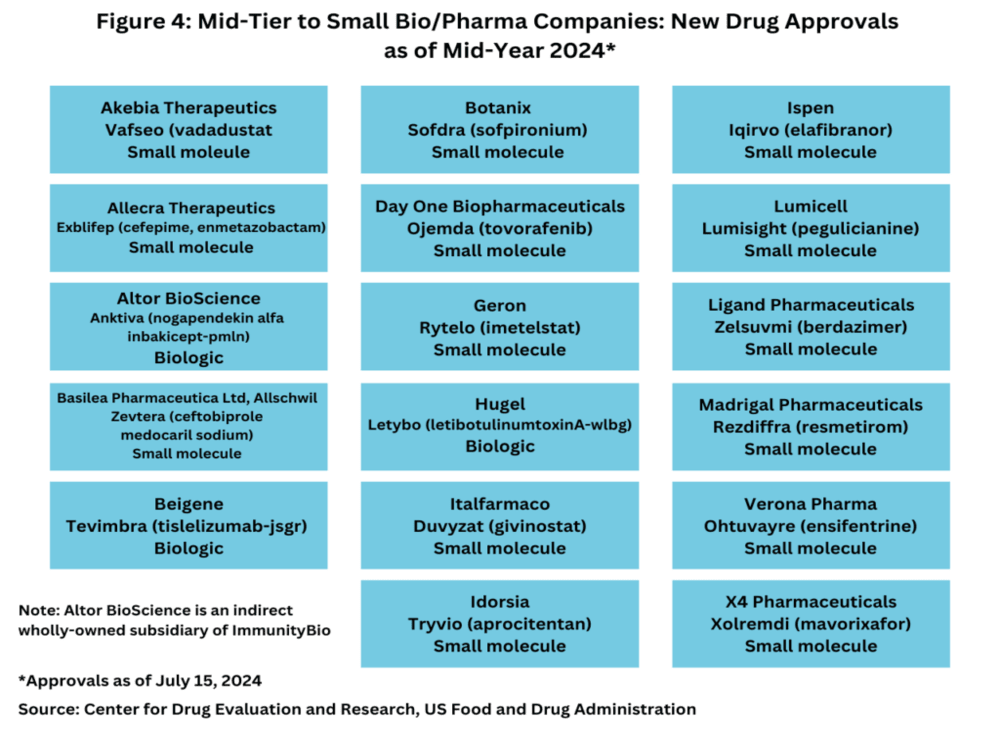

In contrast, mid-tier and smaller biopharmaceutical companies have been particularly active in 2024, accounting for 77% of new drug approvals. Of these 17 approvals, 14 (82%) were small molecules and 3 (18%) were biologics (see Figure 4). This shift highlights a dynamic landscape where smaller firms are making significant contributions to the development of new drugs.

Conclusion

The mid-year review of new drug approvals for 2024 showcases a balanced but evolving landscape in the pharmaceutical industry. While major pharmaceutical companies continue to contribute significant biologics, mid-tier and smaller companies are driving a notable portion of new small-molecule innovations. This trend reflects ongoing shifts in the industry and sets the stage for continued advancements in drug development.

Pharma Sourcing Platform

Pharma Sourcing Platform

Comments are closed.