Explore global pharma industry growth trends for 2024 and see how sourcing platforms drive efficiency and partnerships.

The global pharmaceutical industry experienced robust growth in 2023, characterized by significant value expansion despite modest volume increases. Looking ahead, projections indicate varied growth trajectories across geographic markets, therapeutic sectors, and modalities, reflecting evolving market dynamics and innovation trends.

Global and Regional Growth Trends

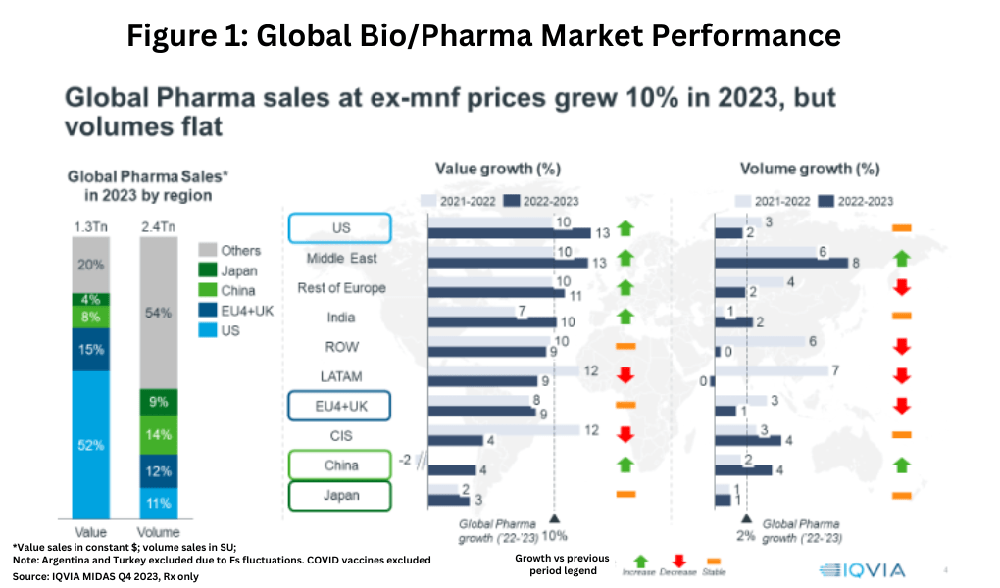

In 2023, the global bio/pharma market surged by 10% on a value basis, reaching $1.3 trillion, while volume growth remained subdued at 2%. The United States led with a 13% increase in value, though volume growth stagnated at 2%, down from 3% in the previous year. Similarly, the EU4 (France, Germany, Italy, Spain) and the UK collectively saw value growth of 9%, with only 1% volume growth. Japan, constituting 4% of the global market, experienced 3% value growth and 1% volume growth. China, capturing 8% market share, showed significant improvement with 4% growth in both value and volume (see Figure 1).

Looking forward through 2028, North America and Western Europe are expected to sustain high spending growth driven by increased usage of novel drugs at higher prices. Conversely, Japan anticipates below-average growth in both volume and spending, while India and Asia-Pacific (excluding Japan) are poised for above-average growth in both metrics. China presents a mixed outlook, with below-average spending growth but accelerated access to innovative therapies boosting overall expenditure.

Small Molecules Versus Biologics

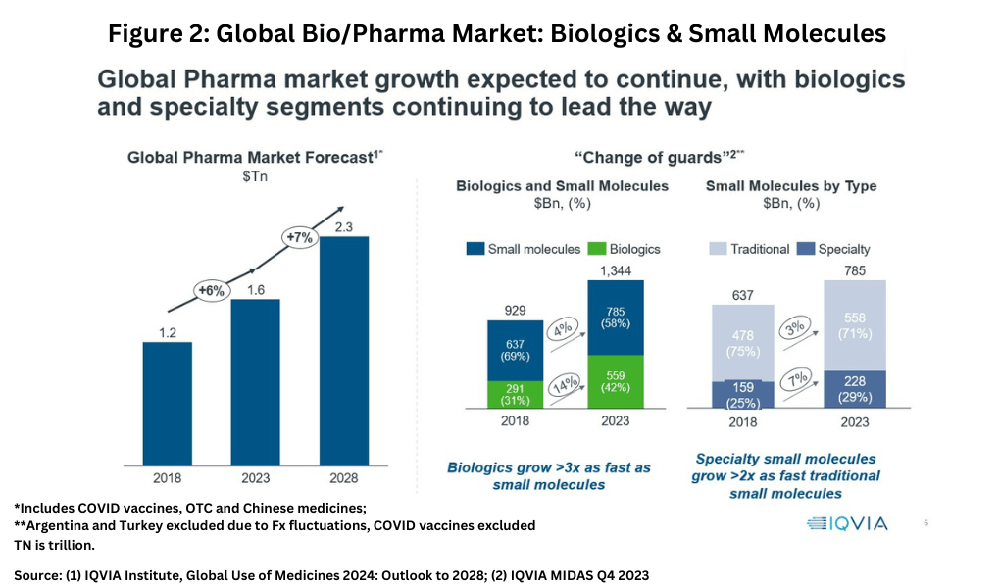

The market dynamics between small-molecule drugs and biologics are undergoing a notable shift. In 2023, small molecules maintained dominance with a 58% market share ($785 billion), while biologics accounted for 42% ($559 billion), up from a 31% share in 2018 (see Figure 2). Biologics demonstrated more than three times the growth rate of small molecules, underscoring a trend towards biologic therapies. Within small molecules, specialty drugs are growing more rapidly than traditional counterparts, although traditional small molecules still command 71% of the sector (see Figure 2).

Therapeutic Sector Growth Trends

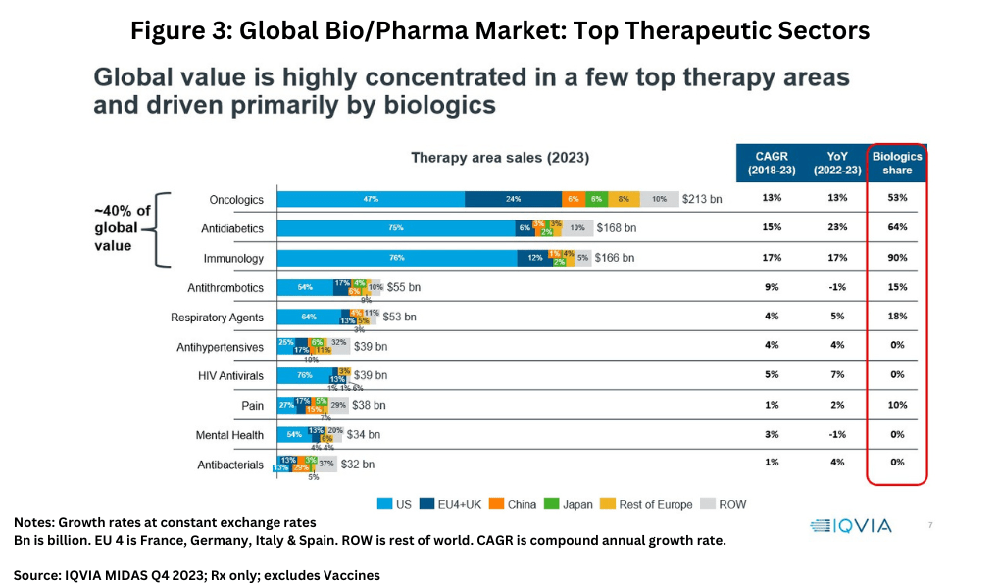

Therapeutically, the global market is highly concentrated in a few key areas predominantly fueled by biologics. Oncology led with a market size of $213 billion in 2023, followed by anti-diabetics at $168 billion and immunology at $166 billion, collectively constituting approximately 40% of the global market (see Figure 3). Challenges persist in these sectors, including pricing pressures and competition, particularly in oncology where targeted therapies are expanding rapidly but face heightened scrutiny from payers.

While oncology, anti-diabetics, and immunology lead in market size, challenges such as cost-effectiveness and innovation continue to shape their landscapes. Oncology, for instance, accounts for about 35% of all pipeline assets, yet the market is increasingly fragmented due to the rapid proliferation of targeted therapies, posing challenges for “me-too” drugs aiming to challenge established standards of care.

Pharma’s Growth Challenges

Pharmaceutical companies confront several challenges moving forward, including stringent payer demands, evolving healthcare infrastructures, and internal pressures to optimize returns on R&D investments. Evaluating pipeline assets against established standards of care remains crucial, with a focus on innovation that either establishes new treatment paradigms or enhances existing therapies.

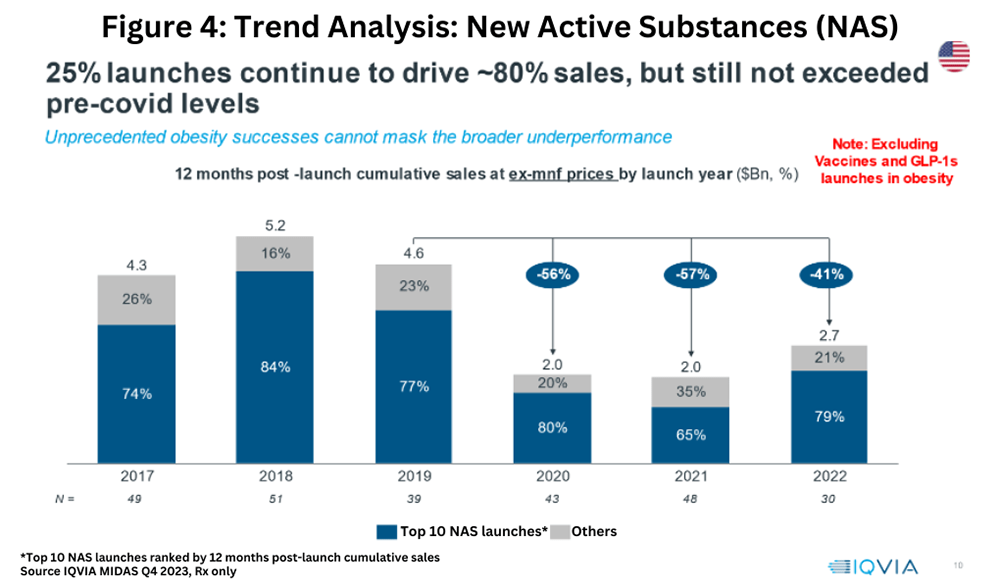

Within this framework, overall product innovation, as measured by the sales of new active substances (NAS), shows mixed results in the US, by far the most important market for new products. A consistent recent trend has been that the top 10 NAS launches (based on 12-month post-launch cumulative sales at ex-manufacturers’ prices) have accounted for approximately 80% of overall NAS sales, but NAS growth has not returned to pre-COVID-19 pandemic levels when excluding launches in vaccines and GLP-1 drug launches in obesity.

Generics and Biosimilars Market

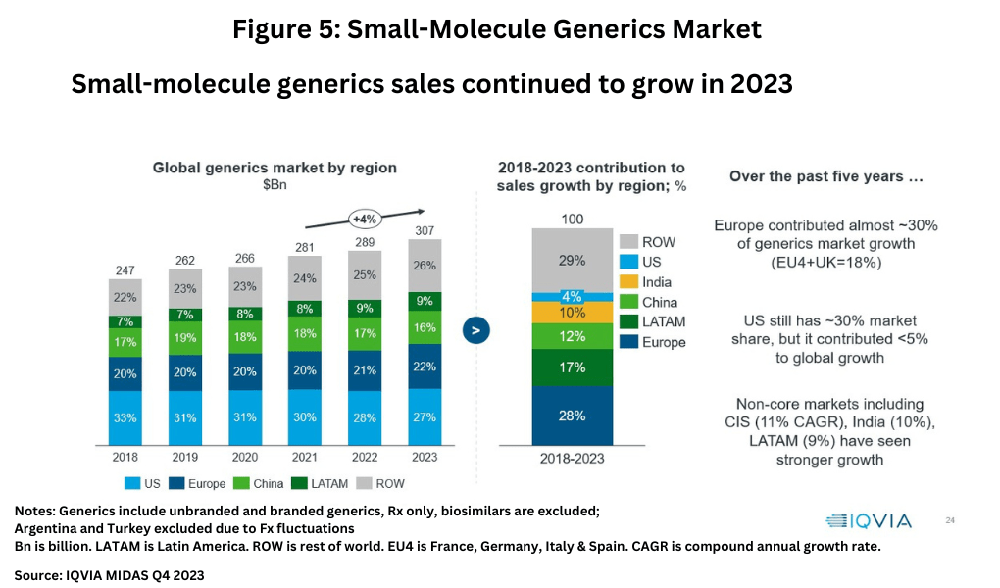

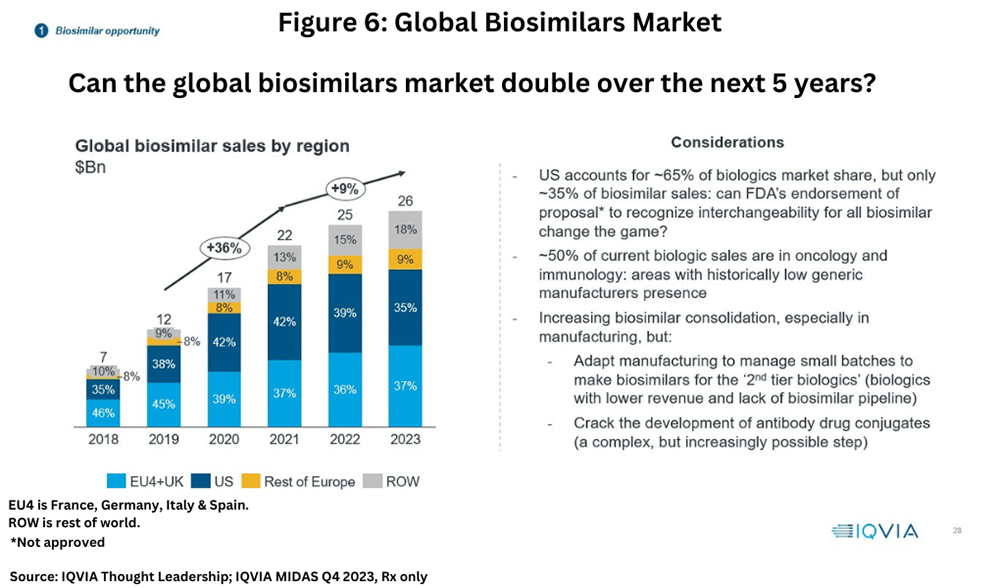

The generics market continues to expand, reaching $307 billion globally in 2023 with a 4% CAGR between 2021-2023. The US leads with a 27% market share, followed by Europe at 22% and China at 18%. Growth outside core markets has been robust, particularly in the CIS (11% CAGR), India (10% CAGR), and Latin America (9% CAGR) (see Figure 5). Conversely, biosimilars, though smaller at $26 billion, exhibit a higher growth rate of approximately 9% between 2021-2023 (see Figure 6), driven by increasing acceptance and adoption, particularly in the EU4, UK, and expanding markets.

The global pharmaceutical landscape in 2023 reflected dynamic growth patterns across regions, therapeutic sectors, and modalities. As the industry progresses towards 2028, continued innovation in biologics, targeted therapies in oncology, and expanding markets in Asia-Pacific are poised to drive significant growth. However, challenges such as pricing pressures, market access complexities, and the need for sustainable R&D investments remain pivotal. Navigating these complexities will be essential for pharmaceutical companies aiming to capitalize on emerging opportunities and sustain growth in an increasingly competitive global market.

Pharma Sourcing Platform

Pharma Sourcing Platform

Comments are closed.