Discover how India is incentivizing diabetes and obesity drug makers, boosting opportunities for API manufacturers.

India is set to introduce incentives starting in 2026 to bolster local manufacturing of GLP-1 drugs used for treating diabetes and obesity. This initiative aims to capitalize on the anticipated expiration of Danish drugmaker Novo Nordisk’s patent on semaglutide, a key ingredient in popular drugs like Wegovy for obesity and Ozempic for diabetes.

Understanding GLP-1 Drugs

GLP-1 drugs, originally developed to manage diabetes by regulating blood sugar levels, have gained traction for their additional benefit in aiding weight loss. These drugs work by slowing digestion, thereby helping patients feel full for longer periods, making them effective in treating obesity as well.

Novo Nordisk’s semaglutide patent is slated to expire in India by 2026, opening the door for local pharmaceutical companies to enter the market with generic versions. This move is expected to foster competition and potentially reduce drug prices, benefiting Indian consumers.

Government’s Production-Linked Incentive (PLI) Scheme

Arunish Chawla, Secretary of the Department of Pharmaceuticals, announced that Indian companies preparing to manufacture GLP-1 drugs have applied for the government’s PLI scheme. This scheme aims to incentivize local production and is contingent upon companies commencing manufacturing after the patent expires in 2026.

Several prominent Indian pharmaceutical companies, including Biocon, Sun Pharma, Cipla, Dr. Reddy’s, and Lupin, are reportedly involved in the initiative. These companies are poised to capitalize on the growing demand for GLP-1 drugs in India, driven by high obesity rates and a significant diabetic population.

Market Dynamics and Economic Impact

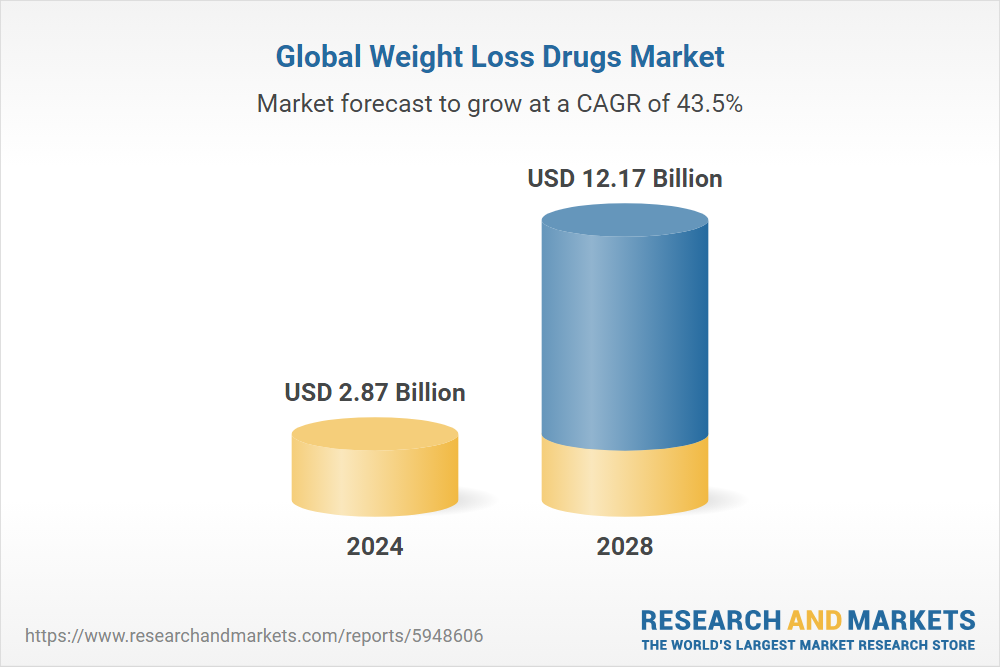

The global market for weight-loss drugs is projected to exceed $100 billion by the end of the decade, underscoring the economic potential for Indian drugmakers entering this segment. With India facing rising obesity rates, particularly among women, and holding the second-highest number of people with type 2 diabetes worldwide, the demand for effective treatments is substantial.

While these drugs are primarily approved for diabetes treatment, their application for obesity treatment depends on regulatory approvals from India’s drug regulator. This regulatory pathway will be crucial for drugmakers looking to leverage their GLP-1 products for treating obesity in addition to diabetes.

India’s initiative to incentivize local manufacturing of GLP-1 drugs marks a strategic step towards enhancing healthcare access and affordability. By encouraging domestic production post-patent expiry, the government aims to stimulate innovation, competition, and market expansion in the pharmaceutical sector. As Indian pharmaceutical companies gear up to enter the burgeoning market for diabetes and obesity treatments, their success will hinge on regulatory approvals and their ability to meet growing healthcare demands effectively.

API Manufacturers

API Manufacturers

Comments are closed.